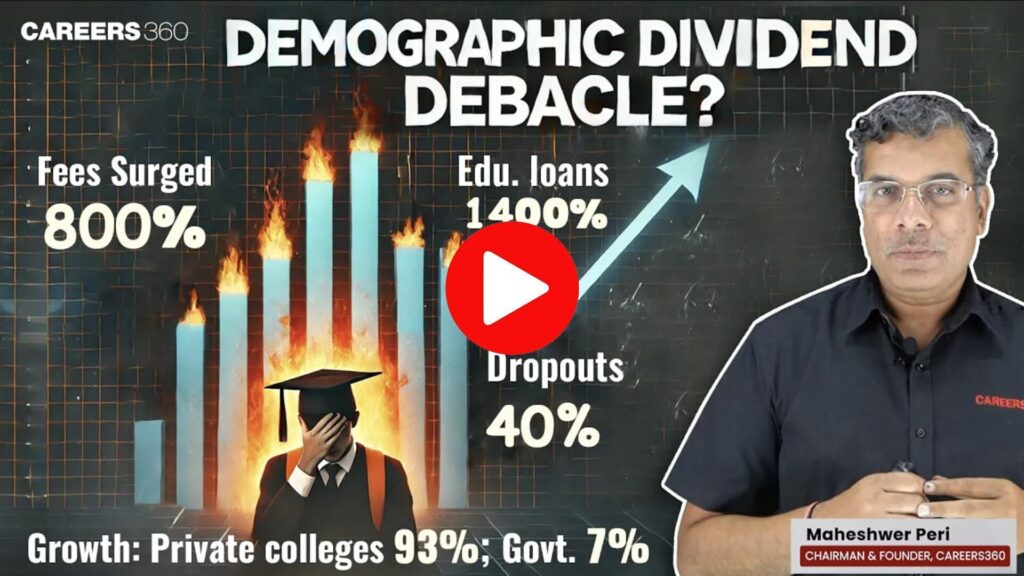

With its burgeoning young population, India stands at the cusp of a demographic dividend. This demographic dividend, however, is facing a serious threat: the soaring cost of education. The cost of education in India has been spiralling upward, making it increasingly difficult for families to afford quality education for their children. This article delves into the alarming trends in education costs, analysing the factors contributing to this debacle and exploring its implications for India’s future.

The Rise of Private Institutions: A Double-Edged Sword

Shifting Landscape of Education Institutions

The Indian education landscape has witnessed a dramatic shift in the last decade, with private institutions rapidly outpacing public institutions in terms of growth. This trend is evident across all levels of education, from schools to colleges and universities.

Schooling System

- Government Schools: The number of government schools in India increased by a mere 8.99% between 2008-09 and 2021-22, from 10.35 lakh to 11.28 lakh.

- Private Schools: In contrast, private schools witnessed a staggering 34.54% growth during the same period, rising from 2.49 lakh to 3.35 lakh. This translates to a four-fold increase in the growth rate of private schools compared to government schools.

Colleges

- Government Colleges: The number of government colleges increased by 10.63% between 2010-11 and 2022-23, from 8,837 to 9,777.

- Private Colleges: Private colleges, however, experienced a phenomenal 47.89% growth during the same period, jumping from 24,137 to 35,696. This means that almost 92.5% of the total increase in college numbers was contributed by private institutions, while government colleges accounted for only 7.5%.

Universities

- Public Universities: The number of public universities increased by 50% between 2010-11 and 2022-23, from 384 to 576.

- Private Universities: Private universities, on the other hand, witnessed a remarkable 229.21% growth during the same period, rising from 178 to 586. This signifies a significant shift in the balance of power, with private universities now outnumbering public universities.

The Cost of Privatization: Rising Education Fees

The rapid growth of private institutions has come at a cost – a steep rise in education fees. This trend is particularly alarming as it disproportionately affects students from lower-income backgrounds, exacerbating existing inequalities in access to quality education.

School Fees

- National Sample Survey: The National Sample Survey (NSS) revealed a significant increase in the cost of elementary and upper primary education between 2014 and 2018. Elementary education costs rose by 30.7%, while upper primary school costs increased by 27.5%.

- Parent Survey: A survey of 27,000 parents across India found that 42% reported a 30-50% increase in their child’s school fees in recent years.

- Case Studies: Numerous anecdotal accounts highlight the exorbitant fees charged by private schools. For instance, a parent in the National Capital Region (NCR) reported a 10% annual increase in school fees, with the school refusing to explain the hike. In another instance, a school in Delhi expelled 13 students for refusing to pay high fees.

College Fees

- IIT Bombay: The tuition fee at IIT Bombay has increased by 7.2 times in the last 15 years, from ₹1.08 lakh in 2008 to ₹8 lakh in 2024-25. This increase far surpasses the inflation index, which has only risen by 2.54 times during the same period.

- NITs: The fee at NITs has also witnessed a significant increase, rising by almost four times in the last 12 years, from ₹1.42 lakh in 2011-12 to ₹5.02 lakh in 2023-24. This increase is again significantly higher than the inflation index, which has only increased by 1.89 times during the same period.

- NLUs: The fee at NLUs, particularly private institutions, has also skyrocketed. For example, the fee at Symbiosis Law Institute in Pune has increased by four times in the last 14 years, from ₹5.75 lakh in 2010 to ₹22.65 lakh in 2024.

- NID Ahmedabad: The fee at NID Ahmedabad has increased by 3.28 times in the last 11 years, from ₹4.8 lakh in 2013-14 to ₹15.72 lakh in 2024-25. This increase is significantly higher than the inflation index, which has only increased by 59% during the same period.

Other Domains

- MBA, MBBS, MTech: The fees charged by private universities for MBA, MBBS, and MTech programs are exorbitant, ranging from ₹80-125 lakh for state private universities to ₹1.25 crore-₹2 crore for deemed private universities. The fees for MBBS programs at some institutions even reach ₹3-4 crore.

- MTech Fee Hike at IITs: In 2019, the MTech fee at IITs was increased by 900% in a single year, although it was phased out over three years. This drastic increase led to a significant drop in MTech applications, highlighting the impact of exorbitant fees on student choices.

The Case of IIM Ahmedabad

The case of IIM Ahmedabad is particularly concerning. Despite its strong financial position, with a balance sheet exceeding ₹200 crore and a cash profit of ₹87 crore, the institute has continued to increase fees. The fee at IIM Ahmedabad has increased eight times in the last 18-19 years, from ₹3.16 lakh in 2005 to ₹25 lakh in 2024. This raises questions about the institute’s commitment to affordability and its focus on producing leaders and visionaries rather than simply churning out high-paying job seekers.

The Education Loan Crisis: A Spiraling Debt Trap

The rising cost of education has led to a surge in education loans, trapping students in a cycle of debt. This trend is particularly worrisome as it can hinder students’ future career prospects and limit their ability to contribute to the economy.

The Growth of Education Loans

- First Education Loan Scheme: The first education loan scheme was launched in 2001, aiming to provide affordable loans with simplified processes.

- Loan Disbursement: By 2005, approximately 4.68 lakh students had availed education loans, with a total loan disbursement of ₹6,713 crore.

- Current Scenario: In 2023, the number of students taking education loans has surged to 3.2 million, with a total loan disbursement nearing ₹1 lakh crore. This represents a seven-fold increase in the number of students taking loans and a 14-fold increase in the loan amount.

The Impact of Education Loans

- Increased Debt Burden: The rising cost of education and the corresponding increase in loan amounts have placed a significant debt burden on students.

- Limited Career Choices: The pressure to repay loans can limit students’ career choices, forcing them to prioritize high-paying jobs over their passions.

- Financial Stress: The financial stress associated with education loans can negatively impact students’ mental health and well-being.

The Consequences of Unaffordable Education: A Lost Generation

The soaring cost of education has dire consequences for India’s future. It is leading to a significant increase in dropout rates, creating a lost generation of young people who are unable to access quality education and contribute to the nation’s growth.

Dropout Rates

- 2014 Data: In 2014, a staggering 45 million students dropped out of the education system due to financial constraints.

- NSS Survey: The NSS survey conducted in 2019 revealed that 22.58% of students dropped out of education due to financial constraints.

- Economic Activities: Another 20.96% of students had to return to economic activities to support their families, highlighting the economic pressures forcing students to abandon their education.

NEET (Not Engaged in Education, Employment, or Training)

- Definition: NEET refers to individuals aged 15-24 who are neither in school, nor employed, nor engaged in any form of training.

- Data: The NEET rate in India is alarmingly high, with 43.8% of females and 16.1% of males in this age group not engaged in education, employment, or training.

The Need for Urgent Action: A Call for Public Investment

The current situation demands urgent action to address the soaring cost of education and ensure that all young Indians have access to quality education. This requires a significant increase in public investment in education, coupled with measures to regulate private institutions and make education more affordable.

Public Investment: The Key to Affordability and Accessibility

- Increased Funding: The government must significantly increase funding for public education institutions, including schools, colleges, and universities.

- Expansion of Public Institutions: The government should prioritise the expansion of public institutions to cater to the growing demand for quality education.

- Affordable Fees: Public institutions should offer affordable fees, making education accessible to students from all socioeconomic backgrounds.

Regulation of Private Institutions

- Fee Regulation: The government should implement stricter regulations on private institutions to prevent exorbitant fee hikes.

- Quality Control: The government should establish robust quality control mechanisms to ensure that private institutions maintain high standards of education.

- Transparency and Accountability: Private institutions should be held accountable for their financial practices and ensure transparency in their fee structures.

Addressing the Education Loan Crisis

- Interest Rate Subsidies: The government should provide interest rate subsidies on education loans to make them more affordable.

- Loan Repayment Schemes: The government should introduce flexible loan repayment schemes, allowing students to repay their loans over longer periods.

- Financial Literacy: The government should promote financial literacy among students to help them make informed decisions about education loans.

The soaring cost of education in India is a serious threat to the nation’s demographic dividend. It is essential to take immediate action to address this issue and ensure that all young Indians have access to quality and affordable education. This requires a significant increase in public investment in education, coupled with measures to regulate private institutions and make education more affordable. By investing in education, India can unlock the potential of its young population and build a brighter future for all.

Youtube Link : https://www.youtube.com/watch?v=hUHPaR47_CI

Leave a Reply