EMI Full Form

Introduction

The word EMI is an abbreviation for Equated Monthly Instalments. Before understanding EMI, you need to know basics like instalments, monthly instalments, loans, loan calculator, rate of interest, flat rate, etc. These concepts may be new to you, but you must get an idea about them as they are important from a financial point of view. Imagine you are in sudden need of an amount of money, but you are not having that much money with you. So, you take a loan from a bank or your friend and you have to pay back the loan with interest. Naturally, the questions like When will you repay the loan? How much is the interest? Can you repay the loan in instalments? may disturb you. This article will help you to understand them.

What is the full form of EMI?

The acronym EMI means Equated Monthly Instalment. Each of the terms Equated, Monthly, and Instalment has its own meaning which will be explained here.

What are the Terms Associated with EMI?

The following are some of the common words associated with EMI.

Principal

Loan

Deposit

Tenure of loan or deposit

Interest

Amount

Instalment

What is Known as The Principal?

The loan amount of money that you take from your friend or bank is the Principal.

Also, the amount of money that any depositor deposits in a bank in terms of fixed deposits is known as the principal.

Note that the loans and the deposits have some fixed period of time, after which they are repaid to the respective borrower and the depositor. This fixed time period is called tenure.

Interests are calculated on the principal in accordance with its tenure.

Thus, adding the interest to the principal will give the total amount that you have to pay for your loan.

How is Interest Calculated?

There are different methods of interest calculation, some of which are as

Simple Interest

The fixed rate of interest that is simply calculated upon the principal for the tenure of the loan or the deposit is called Simple Interest. It is calculated with the following formula

\text{Simple Interest}=\frac{P T R}{100}

![]()

Here, the symbols have the following meanings

P denotes the principal.

T means tenure.

R suggests the rate of interest per year.

Compound Interest

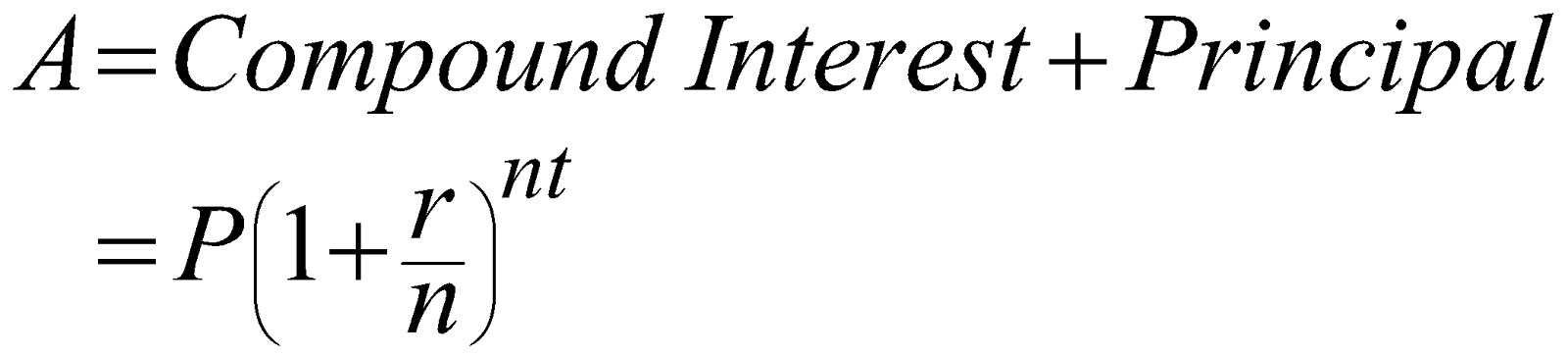

The rate of compound interest that is calculated upon the principal and the interest earned at equal intervals during the tenure of the loan or the deposit is called Compound Interest.

Here the interest is, generally, compounded quarterly or half-yearly.

It is calculated with the following formula, where, the symbols have the following meanings

P means the principal.

t denotes tenure.

r suggests the rate of interest per year.

n implies the number of times interest is calculated per time period or tenure.

A is the amount (principal + interest)

\begin{aligned}

A & =\text { Compound Interest }+\text { Principal } \\

& =P\left(1+\frac{r}{n}\right)^{n t}

\end{aligned}

What is EMI?

Well as you are taking a loan, you cannot repay it immediately. So you have to pay the interest on your borrowed amount. It implies you have to pay back a larger amount than the loan amount you took. For that repayment, the lender allows you a time period.

Say the time period or tenure of the loan is twelve months. It will, naturally, be easy for you if you repay back a part of the total amount per month.

This part payment of the total amount repayable that you pay every month or as per the mutually agreed number of times within the tenure is called the equated monthly instalment or EMI.

How is EMI Calculated?

EMI is calculated in the following steps.

Fix the amount of the loan or the deposit. This is your principal.

The rate of interest is mutually agreed upon between the lender and the borrower.

Fix the time period or the tenure of repayment.

Calculate the interest as applicable.

Sum up the total interest for the tenure and the principal to get the amount.

Divide this amount into the mutually agreed number of time periods equally spaced throughout the tenure.

This equated or equally divided portion of the amount thus includes both the parts of the principal and the interest, and it is the EMI.

Frequently Asked Questions (FAQs)

The following are the advantages of EMI payments

Less burden on the borrower as the repayment is done in instalments.

As evident from the definition of simple interest and compound interest, in case of the compound interest unlike that of simple interest, calculations for interests are done a number of times. So, definitely, compound interest will yield more. Hence, the correct option is b.

As such EMI is applicable to any repayment of loans, some of which are as follows.

Car Loans

Home loans

Education loans

Personal loans

Gold Loans

Loans on Credit Cards

Loans against Fixed Deposits

The term Instalment applies to any part of the payment that may include or exclude the interest payable on the principal of the loan. On the other hand, EMI includes the part of principal and interest as per pre-decided terms between the lender and the borrower.

The following are some of the possible ways to repay the EMI.

Cash Payment

Direct Transfer Payment

Cheque Payment

UPI Payment

Credit card payment